What can you do to cut down on the avoidable risks that may be lurking in your portfolio?

1. Have A Plan

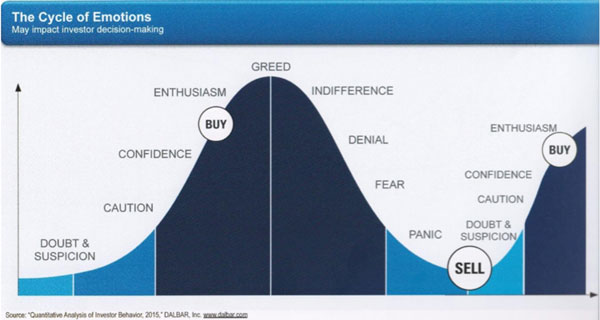

There is an old adage that says, “Success doesn’t just happen; it’s planned for.” If you want to start decreasing your investment risk, then you need to create a plan to do just that. Without a plan, you leave yourself open to emotional decision making in the heat of the moment that could result in the loss of your life savings. The cycle of investment emotions has driven some people to financial ruin. Below is graph of the Cycle of Emotions when investing that can cause financial distress:

If you do not have a plan in place, you will fall prey to an internal struggle of feeling like you are missing out when things are good and worrying about losing when things are bad.

Do not let yourself get to the place of needing to backpedal and regain the control you could have had all along.

2. Set Goals

Do you have a goal for your finances or are you just crossing your fingers and hoping you have enough for the lifestyle you want in retirement? Your specific goals will determine the amount of risk you can and should take with your money. For example, do you want a guaranteed source of income in your golden years? Do you desire substantial growth? Every dollar in your portfolio needs to be working towards a specific goal.

3. Take Action

Finally, you need to follow through on the plan you created and the goals you are trying to attain. Do not let yourself procrastinate where your money is involved. Work with your advisor to ensure that your investments are at the right risk level for your situation and stay disciplined when the markets feel like a roller coaster.

How We Can Help

At Capital CS Group, our goal is to align your risk tolerance with your priorities, such as your financial needs, family values, and charitable interests, with your financial resources in a way that is tailored specifically for you. We would love to sit down with you and make sure that your finances are working for you. To schedule a complimentary financial consultation, or to get a second opinion on your current portfolio, please contact us today.