Navigating the journey to college.

College planning, for parents and child, is about more than saving money. It’s tracking key dates, making big decisions, taking on new responsibilities. We’re here to help you through the entire journey. The Capital CS Group provides guidance on the best savings strategies, account type and investments to successfully navigate the journey to college.

529 College Savings Plan

A 529 Plan is a great way to save for college and gain tax benefits. It allows you to save for college while your money grows tax deferred. The 529 Plan is designed to meet the needs of virtually every family and every budget. What is a 529? Section 529 college savings plans are established by states under section 529(b)(A)(ii) of the Internal Revenue Code as “qualified tuition programs” through which individuals make investments for the purpose of accumulating savings for qualifying higher education costs of beneficiaries. Choices vary by individual plan and also by state and may be limited. Details are available in the plan’s enrollment handbook.

– Account Minimums and Fees: No income limitations

– Contributions must be made in cash

– Each state can establish their own minimums and maximums

Coverdell Educational Savings Account

The Coverdell ESA is a savings plan created for the purpose of paying a student’s qualified educational expenses. These can include, but are not limited to, tuition, books, and uniforms. Like a 529, your money is tax-deferred, allowing your fund to grow faster. Contributions to a Coverdell ESA are not tax-deductible. In addition, contributions are allowed for individuals under the age of 18. Distributions from a Coverdell ESA may be tax-free, but they must be used to pay for qualified educational expenses. With a Coverdell ESA account, you can invest in a wide variety of products including stocks, bonds, and mutual funds.

Custodial Uniformed gift to minors act savings account

With these types of custodial accounts, a minor can own cash or securities that are controlled by a custodian until he or she meets the age of majority in the state the account was set up. All deposits into these accounts are irrevocable gifts to the minor recipient. The Uniform Gift to Minors Act (UGMA) and the Uniform Transfer to Minors Act (UTMA) make it simple to transfer property to a minor without a formal trust and without the restrictions applicable to the guardianship of a minor’s property. Assets in the account become an irrevocable gift to the minor under the Uniform Gift to Minors Act or the Uniform Transfer to Minors Act (UGMA/UTMA). Custodial accounts are not tax-deferred. Taxation of earnings will be dependent on the minor’s tax rate.

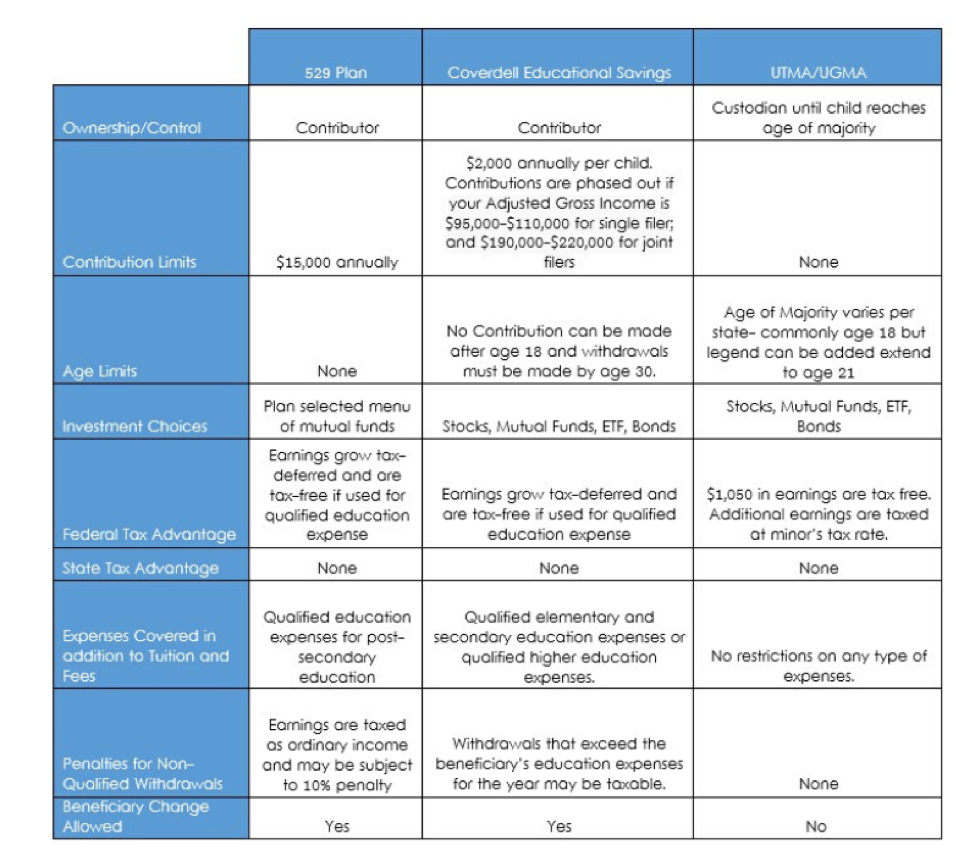

Educational Account Comparison