Options Cheat Sheet

WHAT IS AN OPTION?

A stock OPTION is a contract that gives you the right—but not the obligation—to buy or sell shares of an underlying stock before a certain date, called an EXPIRATION DATE.

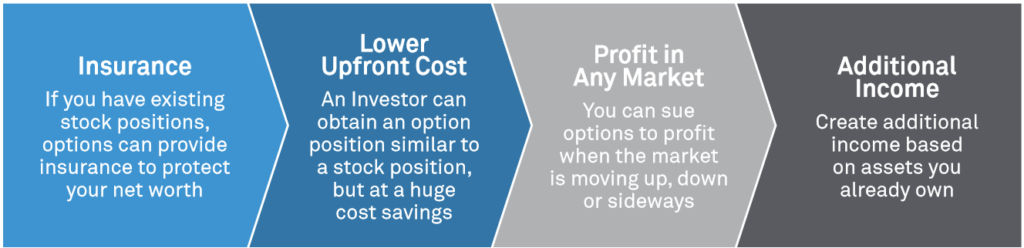

THE BENEFITS OF AN OPTION

THE TWO BASIC OPTIONS

CALL – Pick UP and call

Call options are for when you’re expecting a stock’s value to go UP. A call is the right to buy a stock at a predetermined price (the strike price) on or before the expiration date.

Useful for:

• Profiting from a stock’s gain without paying full price for the stock

• Limiting your downside risk in your portfolio equal to the income received from the option

PUT – Put down the phone

Put options are for when you’re expecting a stock’s value to go DOWN. A put is the right to sell a stock at a predetermined price (the strike price) on or before the expiration date.

Useful for:

• Profiting when a stock loses value

• Protecting your portfolio against losses in an existing position

Example options trade

THE BASIC CALL – CONDITIONS:

- You’re bullish on stock XYZ

- XYZ is currently trading at 50, but you think it’ll go to 60 by December

- You want a small cash outlay versus buying the stock

- You want leveraged profits with limited downside risk

Maximum Risk: Premium Paid

Upside: Unlimited

Breakeven Price = Long Call Strike Price + Premium Paid

XYZ – December 50 Call Option

Premium: $4.50

1 Contract (right to buy 100 shares of XYZ at $50/each)=

$450 Total Investment

FACTS ABOUT OPTIONS

- Options are a derivative, which means you’re not trading the asset itself, but simply a contract based on the asset. Since you do not have to buy the underlying asset, options have a lower upfront cost than stocks.

- The per-share price of an options contract is called the premium. One option contract grants the right to but or sell 100 shares.

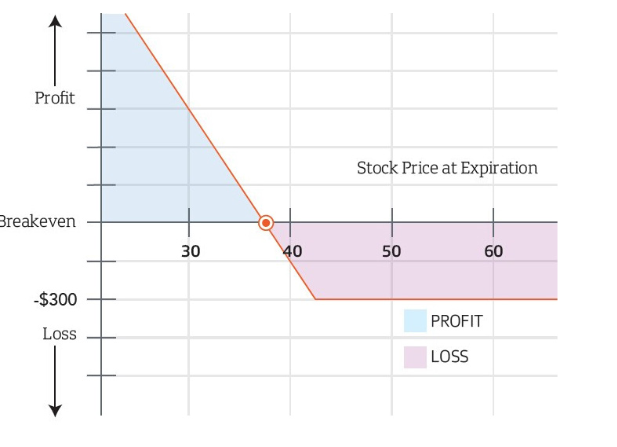

THE BASIC PUT – CONDITIONS:

- You’re bearish on stock ZYX

- ZYX is currently trading at 40, but you think it’ll go to 30 by December

- You want to short the stock, but would prefer a lower risk if the trade goes against you

Maximum Risk: Premium Paid

Upside: Unlimited

Breakeven Price = Long PutStock Price – Premium Paid

ZYX – December 40 Put Option

Premium: $3.50

1 Contract (right to sell 100 shares of ZYX at $40/each)=

$300 Total Investment

- Trading an option requires two parties, a BUYER and a SELLER (or WRITER). The Buyer holds the option to exercise the contract and can do so before the expiration date, while the Seller holds the obligation to fulfill the contract if it is exercised.

- Expiration dates are listed in the form of month and year (e.g. March 2020), and usually expire on the third Friday of that month.