What Do You Do Next?

The US economy is firing on all cylinders, with the unemployment rate falling to a multi-decade low and domestic growth at multi-year highs. However, we also have the uncertainty of trade wars, rising interest rates, and a divisive political environment. Recent market volatility may be showing signs that we may be in the late stages of the current bull market and economic expansion. With the increased uncertainty the common question we get is, “what do I do next?” At Capital CS Group our mission is to bring clarity and confidence to your financial life. A big part of this commitment is helping you make sense of the financial markets and how they might affect your portfolio and financial plan. In this month’s newsletter, we discuss some actions to take with the increasing volatility and uncertainty.

Revisit Your Plan

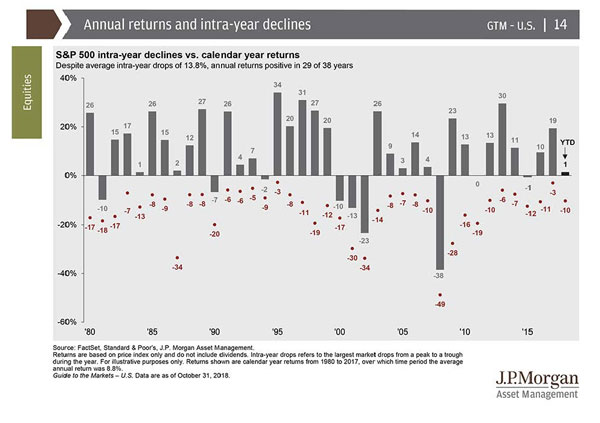

Increased market volatility and uncertainty has a way of making the most experienced investors worry and question their investment strategy. Our advice is to revisit your plan. A financial plan can keep you grounded and focused on your long-term mission. It can remind you that each of your investments has a purpose and market cycles and volatility are factors already built into the plan. The goal of a good plan is to keep you disciplined. We have attached is a great example of the S&P 500 Index showing the importance of keeping disciplined. It illustrates that while intra year declines are the norm, positive calendar year performance has prevailed in 29 of 38 years from 1980-2018.

Review and Rebalance

Diversification is a great way to reduce risk and decrease volatility. In the past nine years we have seen substantial equity market appreciation; therefore you should revisit your portfolio allocation. Your original allocation may have deviated significantly from the target, and your portfolio may no longer be as diversified as you intended.

For example, a buy-and-hold 60/40 equity/fixed income portfolio at the start of the bull market would have become an 85/15 equity/fixed income portfolio (using the S&P 500 Index as proxy for equity allocation and the Barclays U.S. Aggregate Bond Index as proxy for fixed income allocation), as equity market gains have far exceeded fixed income market gains. Our point is to review your portfolio and rebalance in accordance with your financial plan and risk tolerance.

Focus on What You Can Control

When markets get volatile it is normal to want to make a change in pursuit of “more control.” The reality is it’s impossible to control what will happen next in the markets. We recommend you focus on what you can control. For example, if you are retired living off your investments, we recommend reviewing your spending habits and budget. Clients typically pay more attention to where their money goes when markets feel uncertain. Use this time to review your budget and look for areas to save money. We also recommend you do your best to “tune out” the noise of the media. They can stoke fear and anxiety that may lead you to make irrational decisions that will cost you in the long run. The attached article provides some great information on what happens when you miss the best days in the market. Click here to view.

We Are Here to Help

While we can’t predict the future or the next move up or down, we do know that the market can be a great wealth-generating mechanism over the long-term. Unfortunately, volatility is part of investing. Every year there will be new storylines that will cause market volatility. Our goal is to keep you informed so you are comfortable with volatility and can recognize the opportunities it can present. We are here for you. Please let us know if you would like to revisit your investment or financial plan.

If you have any questions, please call us or visit us at

www.CapitalCSGroup.com.